Your Thursday Financial Sorcery Tip:

On Thursdays we Gentlemen for Jupiter offer a blessing to one another: “To Your Blameless Heath, and Necessary Wealth”

On Thursdays we Gentlemen for Jupiter offer a blessing to one another: “To Your Blameless Heath, and Necessary Wealth”

Those last two words are particularly appropriate when discussing wealth magic. We all have a concept of what we consider to be necessary wealth for ourselves – the amount of money we need to pay our bills, put food on the table, and provide a small amount of entertainment and pleasure.

THE NEED FALLACY

Some people that have tried lots of financial sorcery and money magic have noticed that magic aimed at this point of necessary wealth is almost always successful, but that magic aimed at moving far beyond this point is less successful. This has given rise to what I call the “Need Fallacy”

Have you ever heard someone say something like: “I can conjure up the cash for the bills, but anything beyond that seems to elude me”. Or perhaps: “The spirits will give you what you need, but just what you need”. Or maybe even “The Lord knows what you need, which is not always what you want.” If so, you have heard someone that has bought into the Need Fallacy: that magic will work to cover the bills, but not to make them wealthy.

If we are following the Financial Sorcery philosophy, this is a big problem. The whole point that differentiates Financial Sorcery from simple Money magic is the idea of rejecting the status quo and building wealth far beyond mere need according to a long term strategy.

WHAT IS NECESSARY?

As anyone can see though, what exactly constitutes “necessary” is different for everybody. Chances are right now you are living in a style that is more than just a roof over your head, and three hot meals. If it were true that magic only provided for needs, we would all be at the same level, so clearly the actual number differs from person to person.

This variance in the need point is sometimes interpreted by people along theistic, or at least fatalistic lines. The spirits, or God, or powers give you what they think you should have. I completely reject this scenario.

In my experience the lifestyle that we are living is usually representative of our set point. The set point is the financial position you are comfortable at. It is not the point that you would like to be, it is the point that you are comfortable at, and which you unconsciously gravitate towards. This point is set by your upbringing and your general general self-perception. The point that we need to keep in mind here is that whether we are living in a Mansion in Monaco, or an efficiency in Detroit, the need point is simply the point of income that we need to pay the bills.

MOVING THE GOAL POSTS

If the need point is different for different people, and if we reject the idea of it being fated or determined by an immutable power it should be obvious that if you can move the need point, your magic will fall in line around the new point.

From the long term perspective the best way to move the need point is to move the mental set-point that determines it, but that is not what I want to write about in this post. I have a whole chapter on The Set Point it in the new book and I encourage you to see Financial Sorcery for more detail on how to do that.

If however you are not yet ready to tackle the hard work of moving the set point, and make no mistake, it is a long term process of initiation, the least you can do is get the point to work for you rather than against you.

HELPLESS AUTOMATION MAKING ULTIMATUM TO YOU

So magic tends to be really good at paying the bills, but have you ever thought about how many of your bills are voluntary? First we have the things that are more or less the norm and can only be paid for as recurring bills:: Cable, Internet, Phone, Investment fees, etc.

There are however a lot of things that we choose to have automatically debited from our bank accounts which are more leisure oriented: gym memberships, Weight Watchers, EZ Pass, Netflix, and so on. Once you agree to the contract, these stop being things that you think of as optional purchases, and instead fall mentally under the category of necessary bills. So much so that many people pay for these services for months without ever using them. I know I pay $17 a month to weight watchers and haven’t touched it in over a year. It just sort of fades into the financial background that we call “the bills”.

There is no reason that you cannot do to yourself what the government, gym, and all these other services have been doing for years: automatically deducting their cut from your checking account before you get a chance to blow it on tarot cards and DVD’s.

Most companies with direct deposit allow you to channel your paycheck into multiple accounts, either by percentage or firm number. You can very simply direct the company you work for to deposit a small amount from each check into your online high yield savings account*. From that account it is easy enough to can get your investment company (like Etrade) or brokerage firm (like Sharebuilder) to set up automatic investing into whatever you choose. You won’t want to do everything this way. Your resource investments in the “Stans” or your Mongolian Bond purchases are something you will want to be more hands on with.

By making your savings and investing something that is handled along with all your other recurring bills rather than something you have to initiate like a purchase you make them part of your necessary wealth. You shift wealth building from being something new that is done in addition to the norm, into being part of the norm. It becomes just another recurring expense, and the magic that is aimed at maintaining your normal expenses and keeping your status quo, handles those as well as your house and car.

Try it.

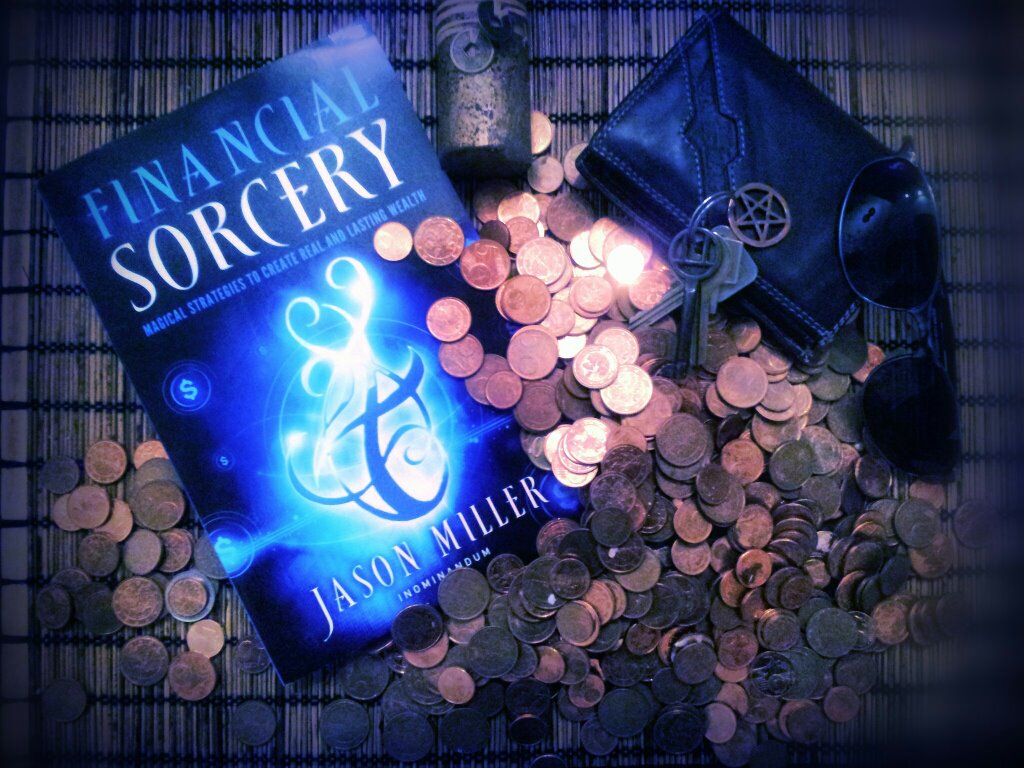

PS: Many thanks to Mr Gaspar in Germany for the awesome photo of the book. Your eye for color and style is amazing.